By Luke Stenis

InvestingAnswers.com

In today's world of corporate bailouts, economic backpedaling and political bickering, we still find the money to pay our star athletes more than modest fortunes for their fame and glory on the field.

[For more on star athlete salaries, read 30 of the Highest Single-Game Paychecks in Sports.]

Many star athletes are able to build and maintain their wealth through savings and investments, but not all who cash big checks are successful with their money management.

The 15 star athletes on this list all have one thing in common: They lost a small fortune seemingly overnight to bad investments -- all were victims of poor judgment or bad luck.

From pistachio farms and bowling alleys to private jets and Ponzi schemes, these bad investments sunk fortunes and fame for many of the following star athletes:

Torii Hunter

Inflatable Furniture Rafts. Many sports fans know that Hunter made his fortune robbing homeruns from juiced-up players during the steroid era of Major League Baseball. But not many fans know he lost nearly $70,000 a few years back from an investment in inflatable rafts for furniture. Yes, you read that correctly. The pitch that sold him was that during a flood, people can pump up the device, and their furniture will float and stay dry. Hunter invested $70,000, but when the guy came back with no product and asking for $500,000 more, Torii came to his senses. Hunter never saw any of his money again, but signed a lucrative deal in 2007 with the Angels, so his bank account isn't hurting too badly.

Roy Halladay, Patrick Ewing, Erik Bedard

Real Estate Properties. An investor group -- which includes Roy Halladay, Patrick Ewing, Erik Bedard and several other professional athletes -- recently loaned and lost millions of dollars to real estate company Atherton-Newport. Atherton-Newport used the unsecured loans to partner with Fidelity Investments for approximately $97 million worth of real estate properties. Atherton-Newport defaulted on their obligations, declared bankruptcy and currently has no money available to pay back the athletically-gifted investor group.

Deuce McAllister

Nissan Car Dealership. In 2010, Deuce McAllister formally retired from the NFL as the Saints' all-time leading rusher, a two-time Pro Bowler, Super Bowl champion and perennial fan-favorite in the Big Easy. Unfortunately, McAlister's Nissan car dealership in Jackson, Mississippi -- Deuce McAllister Nissan -- wasn't as successful as his football career, and the dealership filed for Chapter 11 bankruptcy protection in 2009. According to sources, Nissan sued McAllister for approximately $7 million on defaulted loans, interest and exceeded credit limits.

Art Monk

Terry Orr's Shoe Company. NFL Hall of Famer Art Monk is widely considered one of the greatest wide receivers in the history of professional football. His post-football career is nearly as impressive, founding a number of businesses, including Alliant Merchant Services, the Good Samaritan Foundation and the Art Monk Football Camp. But Monk was also the victim of a bad investment with a friend and former teammate, Terry Orr. In August 2001, Terry Orr was convicted of defrauding Art Monk and three former Redskins teammates, who had invested $50,000 each in Orr's shoe company. Instead, Orr used the money to pay off personal debts.

Rocket Ismail

Rock n' Roll Cafe. In 1991, Notre Dame sensation Rocket Ismail signed a guaranteed $18.2 million, four-year contract with the CFL's Toronto Argonauts -- which was the most lucrative contract in the history of professional football at the time. That same year, Ismail invested $300,000 in a Hard Rock Cafe/Planet Hollywood knockoff called "Rock n' Roll Cafe." While his advisor assured him it was fail-proof, Ismail lost his entire investment and has no idea what became of the restaurant.

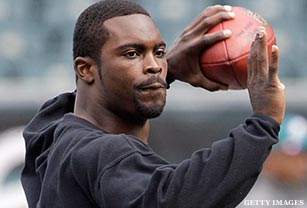

Michael Vick

Wine Shop/Car Rentals/Real Estate. Where to begin?! By now you should be familiar with Vick's history of dog-fighting charges and time served in prison, but that wasn't all he was charged with in the end. In 2008, Vick also filed for Chapter 11 bankruptcy because he was unable to repay $6 million in loans used to invest in a variety of business ventures, which included a car rental operation in Indiana, real estate in Canada and a wine shop in Georgia. Since his release from prison, Vick has been able to turn his finances and career around for a positive trajectory once again.

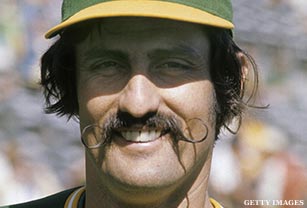

Rollie Fingers

Pistachio Farms/Arabian Horses/Wind Turbines. Three-time World Series champ and Hall of Fame pitcher Rollie Fingers not only had one of the greatest names in the game, he also sports an infamous waxed handlebar moustache -- which he originally grew to earn a $300 bonus from Athletics owner Charles O. Finley. Four years after his retirement in 1985, Fingers' long-term investments in pistachio farms, Arabian horses and wind turbines caught up with him. In 1992, he filed for bankruptcy, where he listed his assets at less than $50,000.

Terrell Davis, John Elway

Hedge Fund Ponzi Scheme. Former Broncos teammates Terrell Davis and John Elway share more in common than two Super Bowl rings; they were both victims of hedge fund Ponzi schemes as well. Davis was defrauded by Atlanta hedge fund manager Kirk Wright, who took his clientele for a smooth $150 million. While Wright has since committed suicide in prison, there is a lawsuit pending for several of his clients, who are still out a great deal of money. Elway was one of many who lost $15 million to a Ponzi scheme run by hedge fund manager Sean Mueller. Don't feel too badly for Elway, he has been very successful in his other investments.

Mike Pelfrey

Ponzi Scheme. Mets pitcher Mike Pelfrey was one of the many MLB players -- including Johnny Damon, Xavier Nady, Scott Eyre and Jacoby Ellsbury -- who fell victim to the $8 billion Ponzi scheme orchestrated by wealth manager Allen Stanford. Pelfrey estimated that 99 percent of his money was tied with the company, which had all of its assets -- including Pelfrey's -- frozen by the U.S. government after fraud was detected.

Eric Dickerson

DFJ Italia. Dickerson was the fastest running back to ever reach 10,000 career rushing yards. He was also the fastest NFL player to get on board with dubious financial advisor, Luigi DiFonzo, whom he met at a Hall of Fame dinner in Canton, Ohio. DiFonzo was actually a repeat felon posing as an Italian Count. Dickerson wasn't the only NFL player swindled by DiFonzo, who admitted to specifically targeting NFL players before he committed suicide in prison in 2000.

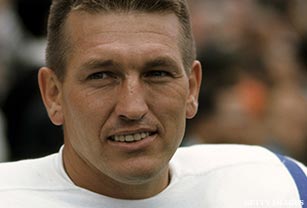

Johnny Unitas

Restaurants, Bowling Alleys. Johnny "The Golden Arm" Unitas is considered one of the greatest players in NFL history, with a record-setting career spanning three decades. He isn't, however, considered a great investor. After his NFL career, Unitas invested his money in many business ventures: restaurants, real estate and bowling alleys. But his investments didn't perform as well as his own football career. In 1991, Unitas declared bankruptcy after investing in a failed Reistertown circuit board manufacturer. Upon his death in 2002, the Unitas Management Corp. also filed for bankruptcy concerning his estate.

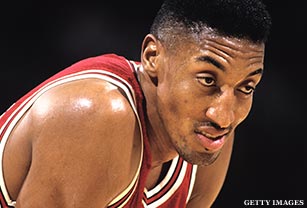

Scottie Pippen

Private Jet, Real Estate. Hall of Famer Scottie Pippen was instrumental in six NBA championships with the Bulls throughout the 1990s. He was the "Robin" to Chicago's "Batman," Michael Jordan. Unfortunately, Pippen was not as successful with investing his money as he was on the basketball court. His first bad investment, a private jet plane, put him in the hole early. It was the real estate investment busts, however, that reportedly account for $27 million of lost fortune for Pippen.

Lenny Dykstra

Luxury Jet Company, Websites, Car Washes. While he was considered a "spark plug" on the baseball diamond, on the field of investing, Dykstra didn't fare so well. In 2008, Dykstra launched a high-end jet charter company and magazine that offered financial advice for professional athletes. He launched a website "Nails Investment" to further spread his investment ideas. At the time, Dykstra's net worth was estimated at $58 million. But it didn't take long before his financial empire went into a tailspin. Since 2001, it is reported that Dykstra has been subject to at least two dozen legal actions. In July 2009, Dykstra filed for Chapter 11 bankruptcy, listing less than $50,000 in assets and $10-$50 million in liabilities. On April 13, 2011, Dykstra was arrested for investigation of grand theft, a day after being charged with a federal bankruptcy charge.

Kareem Abdul-Jabbar

Shady Investment Adviser. The most prolific scorer in the history of the NBA, Kareem Abdul-Jabbar, knows a thing or two about winning on the court. But early in his career, he didn't show the same smarts when choosing investment advisers. From 1980-1986, Kareem's investment adviser, Tom Collins, had taken out more than $9 million in loans under Kareem's name and made risky investments without Kareem's knowledge. By the time Kareem became aware of the financial catastrophe Collins had gotten him into, it was too late. All Kareem's money was gone. In an interview with Sports Illustrated, he said, "It's been a crash course in business school and I've paid a steep tuition."

Related Stories:

-- Million-Dollar Sports Injuries

-- Best-Selling NFL Jerseys

-- Athletes With Foreclosed Homes